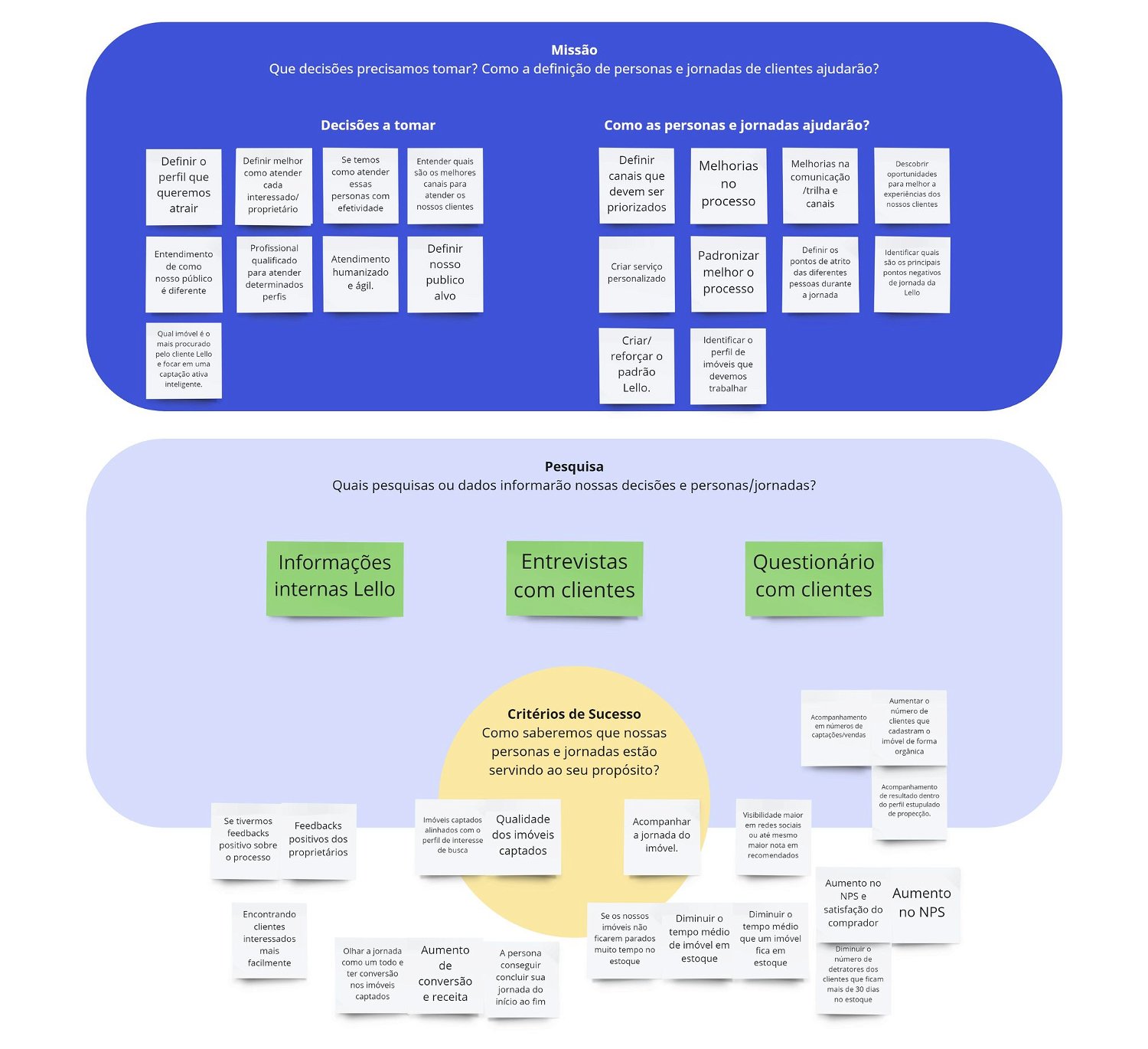

The context

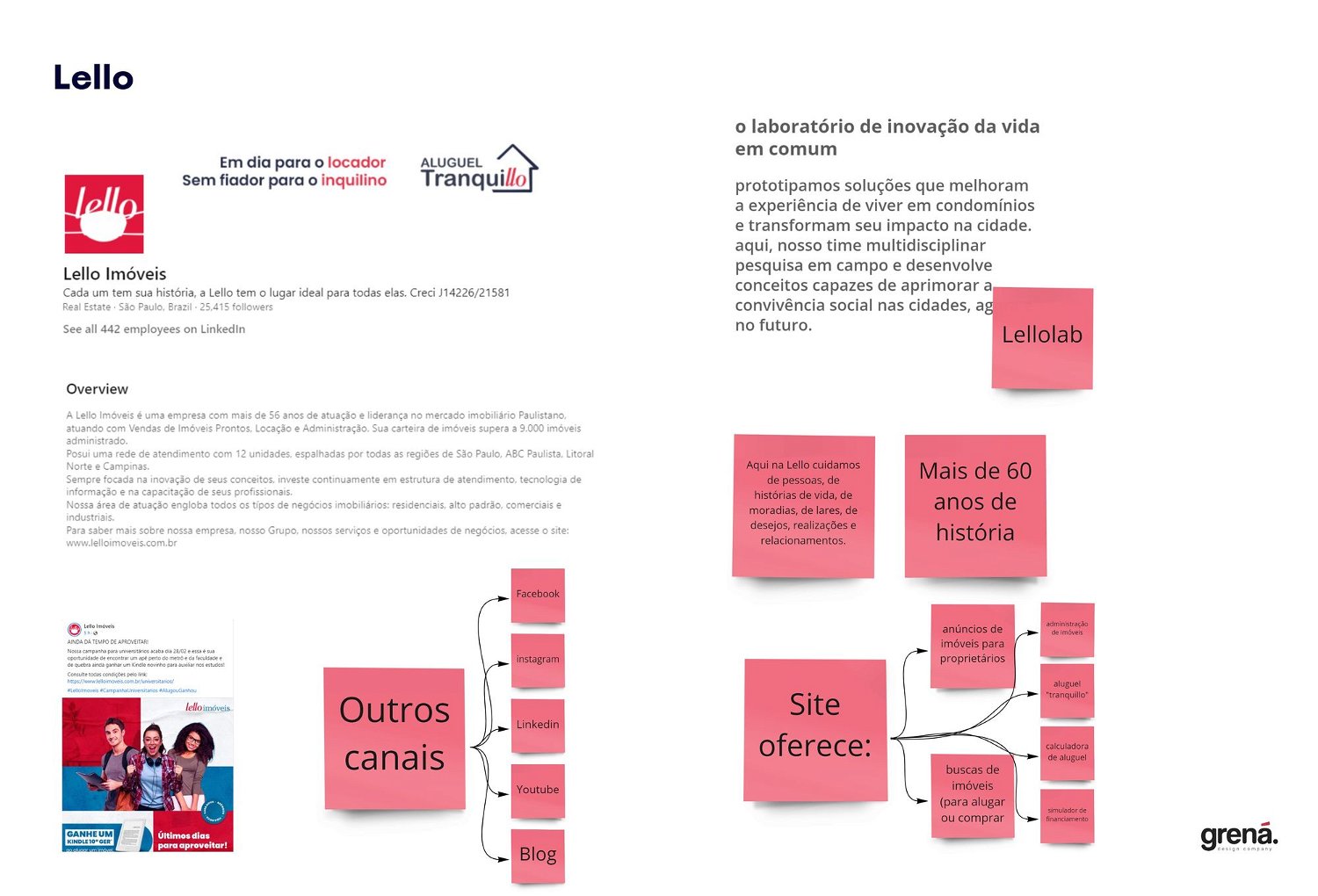

Lello Imóveis is a traditional real estate company from São Paulo, Brazil, with over 60 years of history.

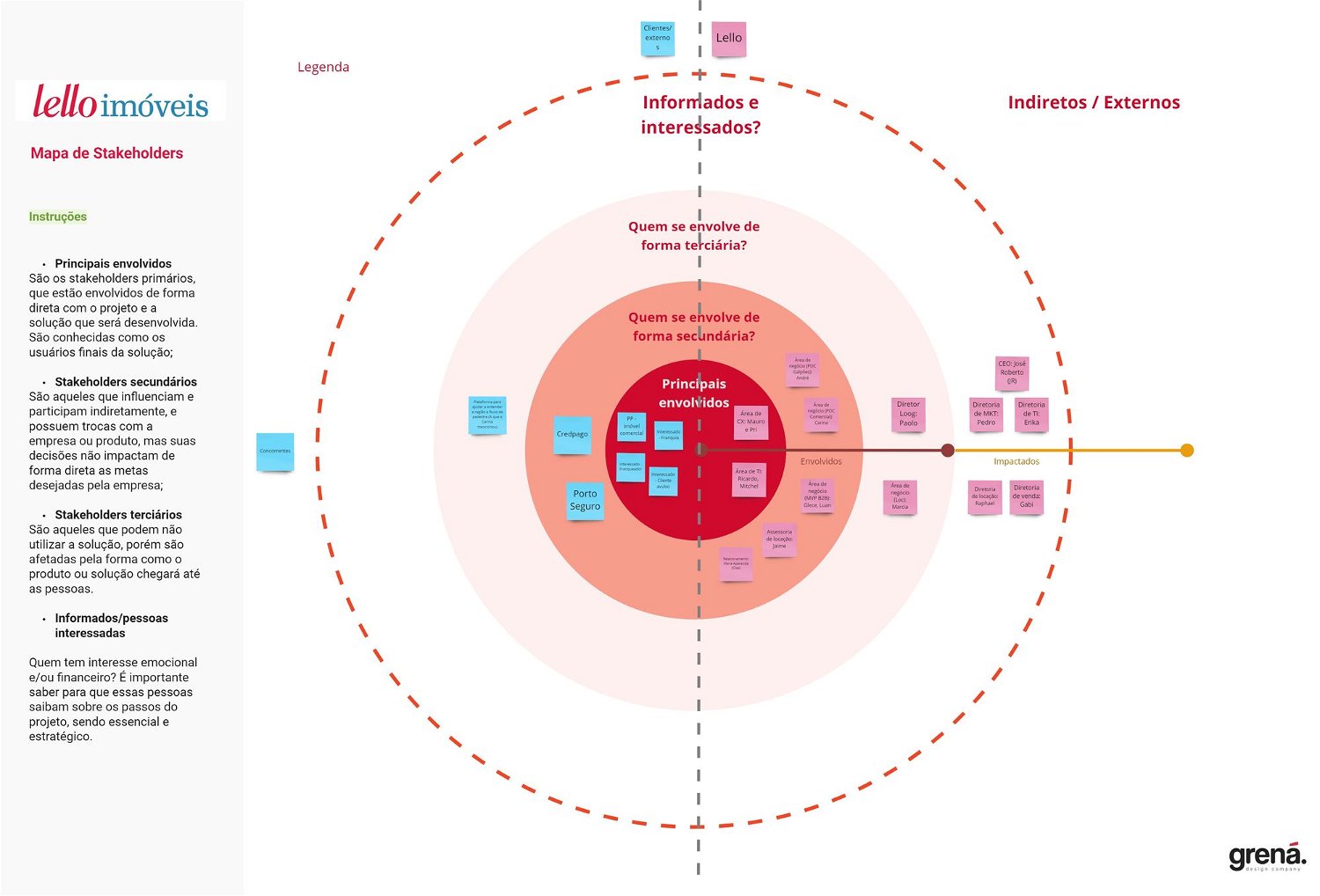

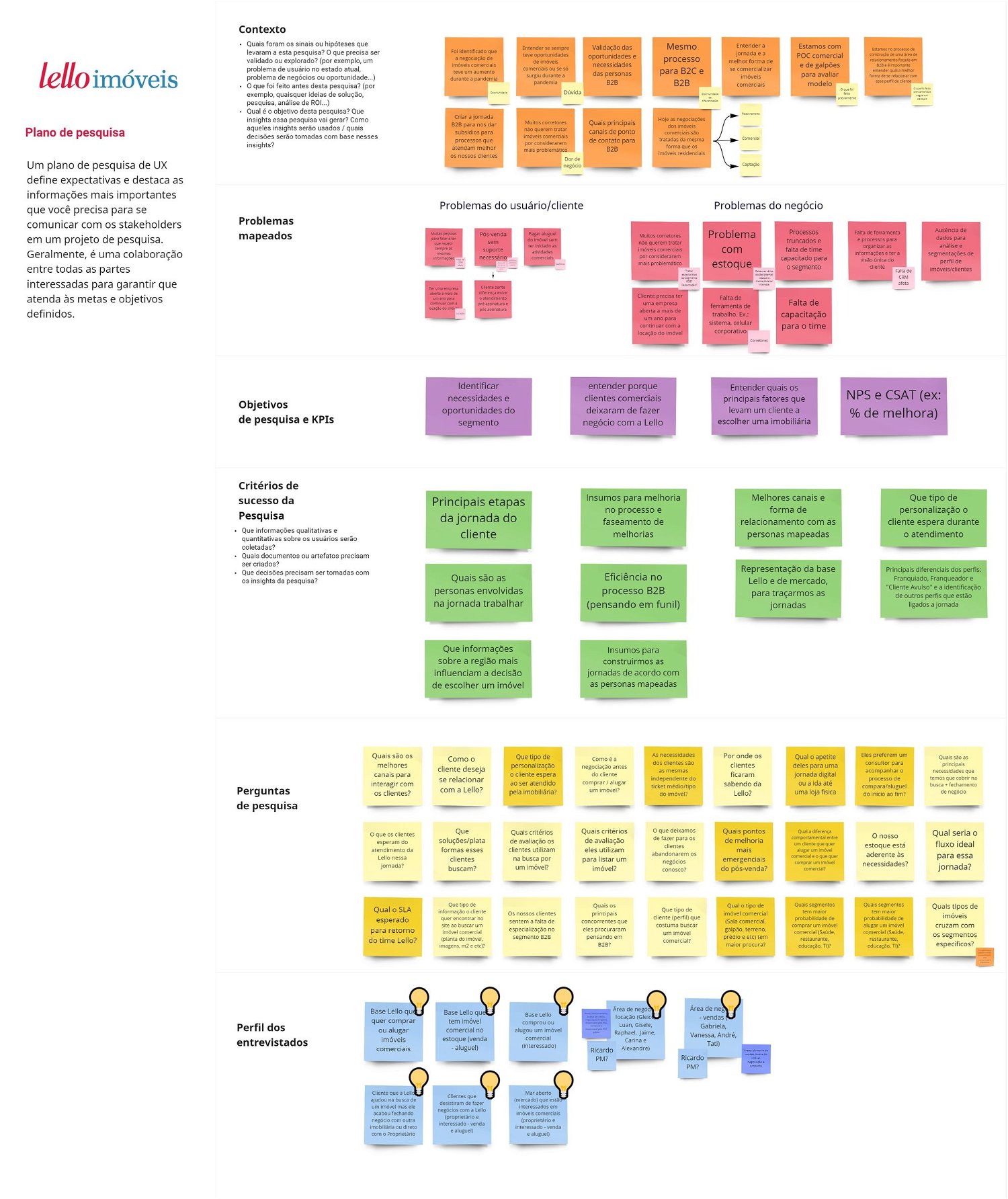

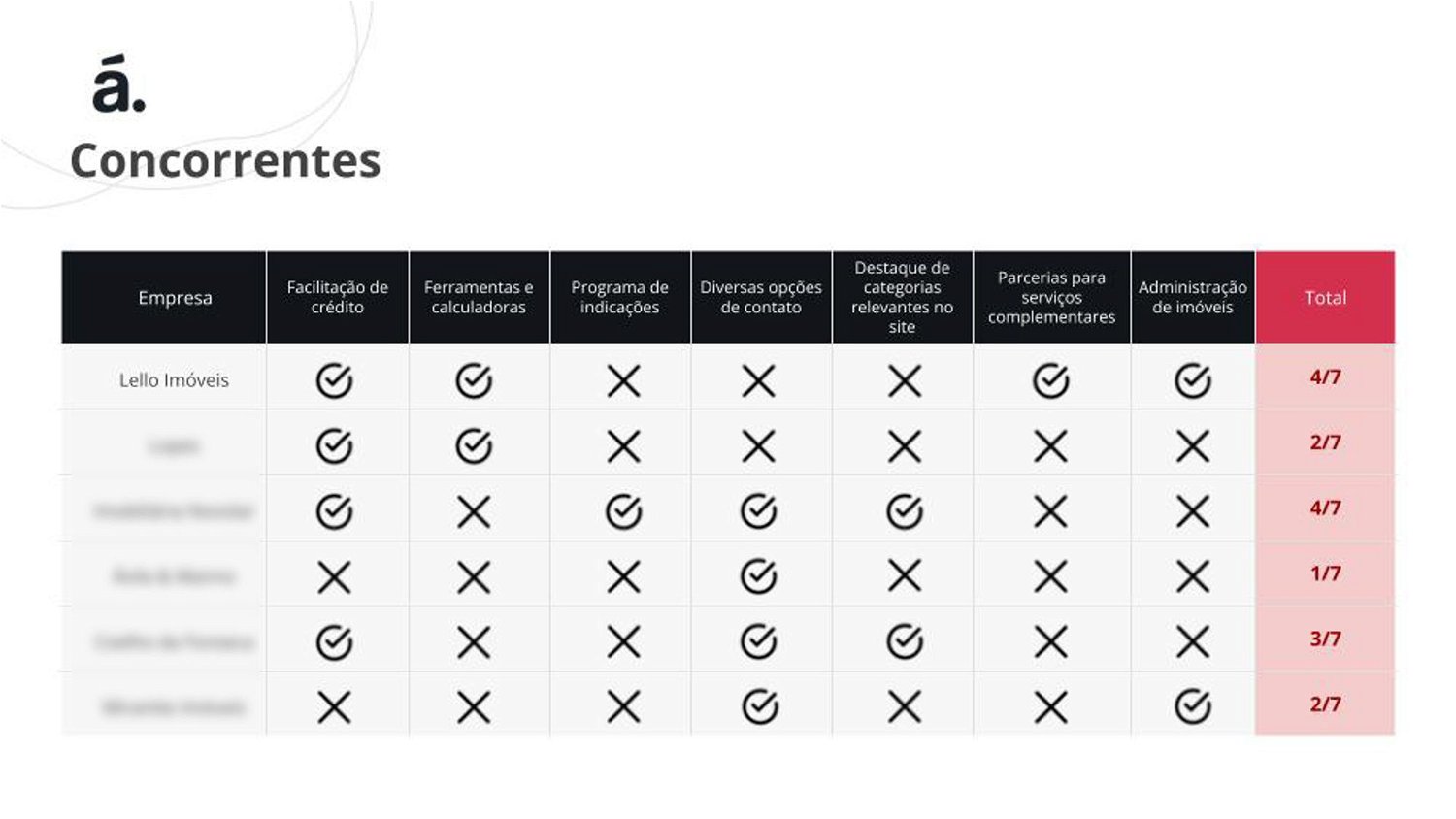

They work with all kinds of properties, however, Lello is mostly known in the residential and property management segments. They approached us because the company is looking to differentiate itself and gain more customers on the commercial (real estate that is used for business activities) side as well.

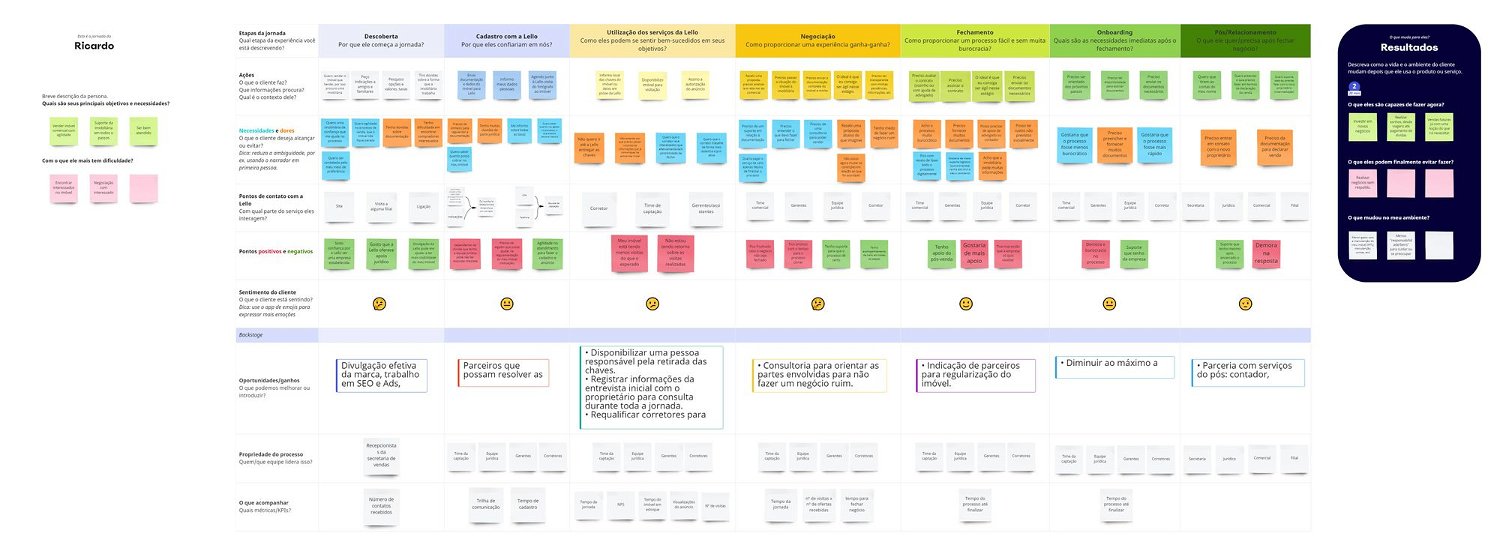

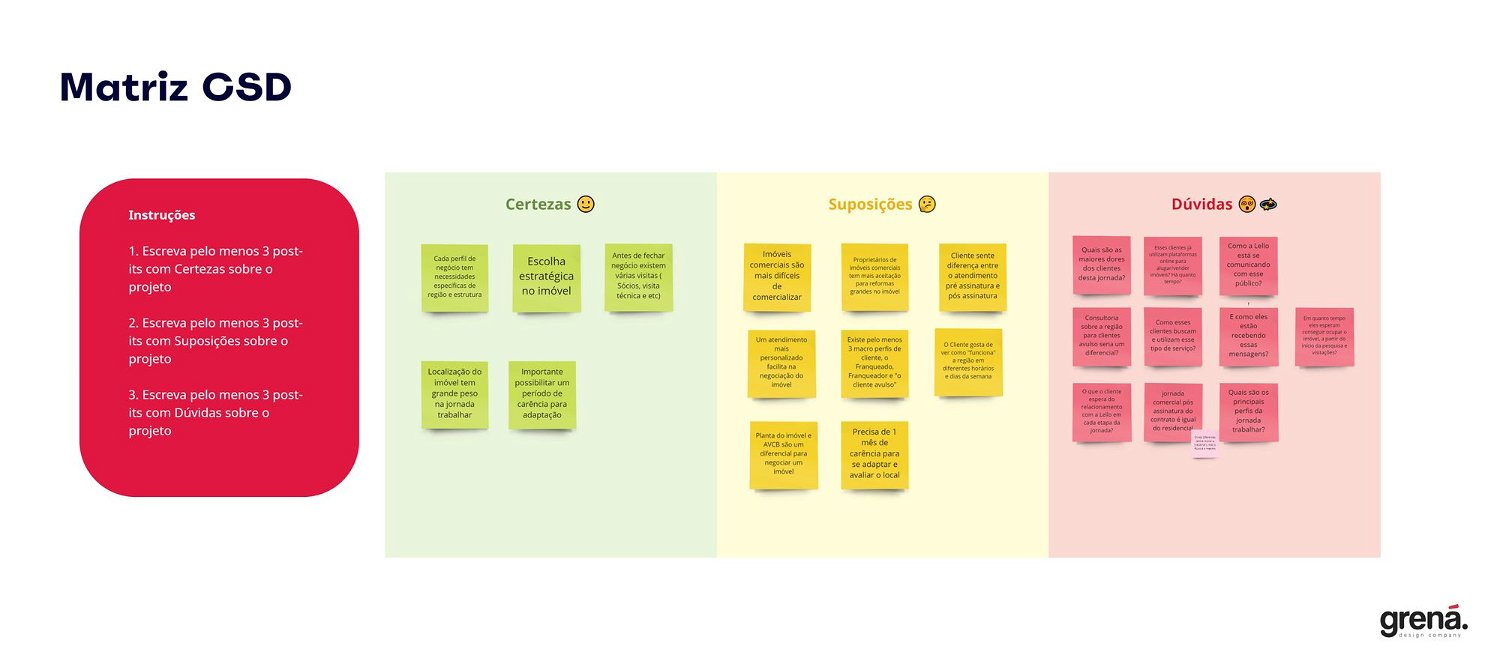

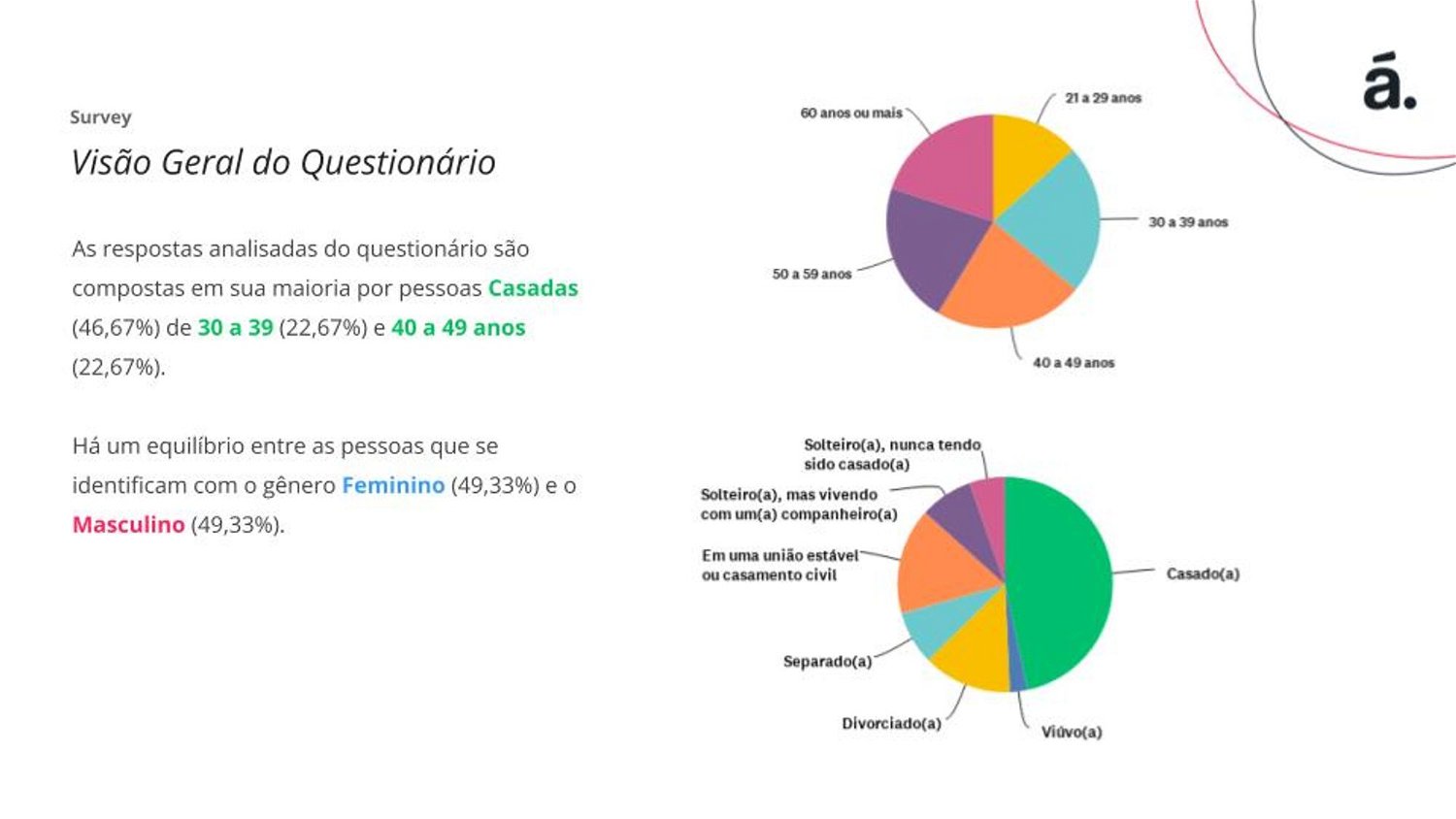

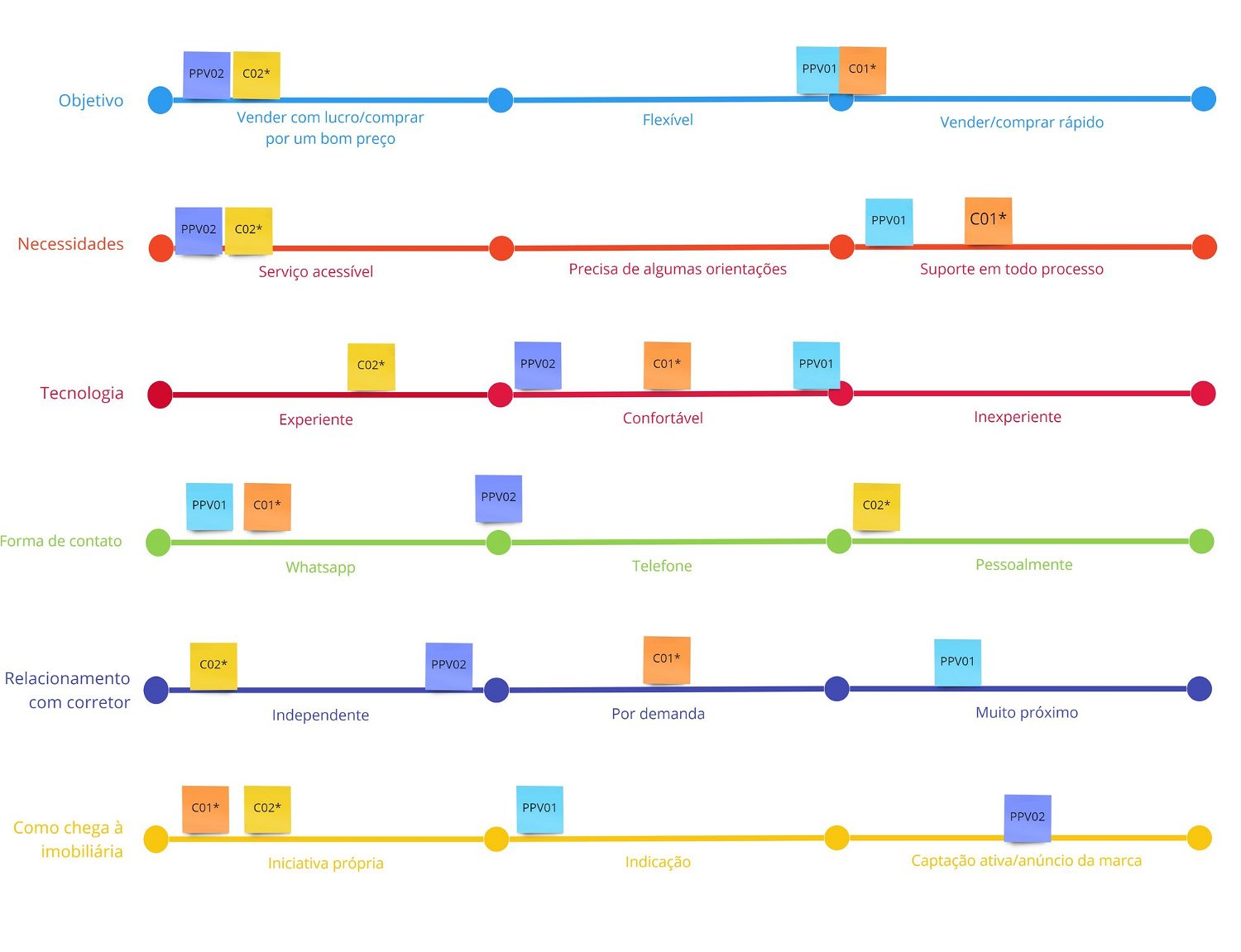

As of March 2022, all clients and types of property were the same for the company in terms of journey and customer service. However, they started to realise that they should treat residential and commercial very differently. The Customer Experience (CX) team thought the customer journeys were very similar for both segments and the personas differed, but, with some preliminary research, learned that was not the case.

.jpeg%3Ftable%3Dblock%26id%3Dc44f8e48-e019-4732-9535-a57e4bc70a02%26cache%3Dv2?width=1500&optimizer=image)

.jpeg%3Ftable%3Dblock%26id%3Dc735c682-0ed4-4455-a5bd-5aea0d85e2c9%26cache%3Dv2?width=1500&optimizer=image)